by Giorgia Andrei |

Presented at the beginning of April, the research by theInternet of Things Observatory of the School of Management of Politecnico di Milano presented at the beginning of April, the Politecnico di Milano research report presents a picture of a country in which the IoT continues to grow at a fast pace, especially in the areas of Smart Home Smart Factory and Smart City.

Giulio Salvadori and Angela Tumino, Directors of the Observatory, comment: "Growth is driven by new communication technologies and services enabled by connected objects, a sign of a market that is growing in maturity as well as in terms of turnover . At the same time, the technological evolution continues: Low Power Wide Area communication networks are expanding, and more and more cases of use and experimentation enabled by 5G are taking place, stimulating new market opportunities, both in consumer and business contexts or in relation to PA. The services component now accounts for 37% of the market and the trend is clear: we are witnessing a real process of "servitisation" of traditional business models, which are increasingly evolving towards pay-per-use or pay-per-performance logics, opening up market opportunities".

Values and market segments

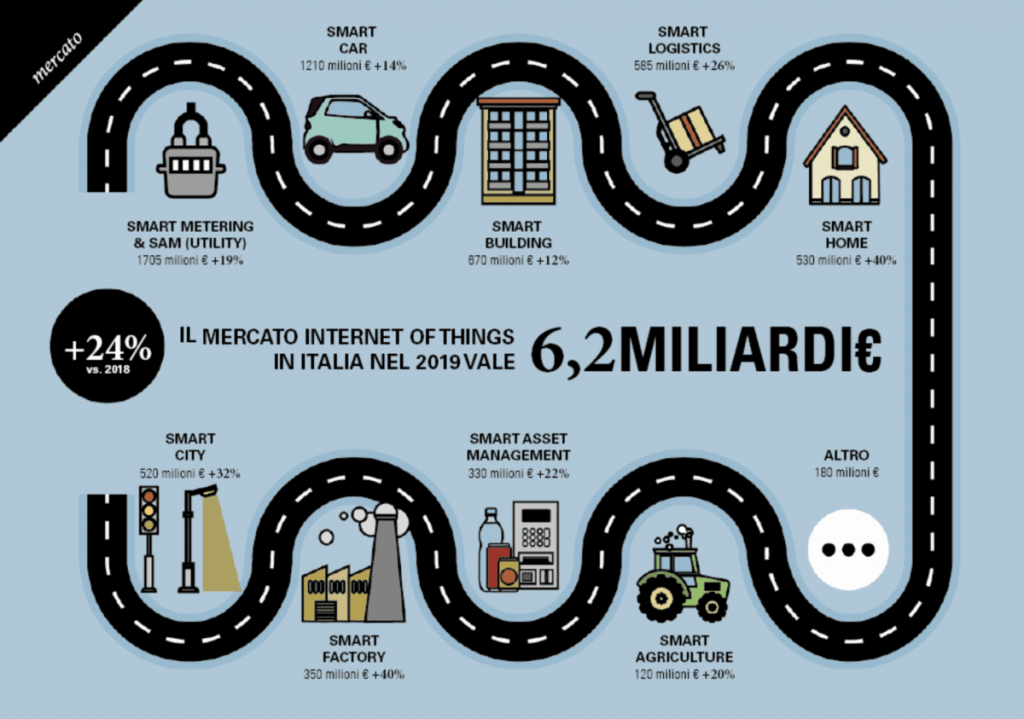

The Italian Internet of Things market in 2019 reached a value of €6.2 billion, with growth of €1.2 billion and 24% compared to the previous year, aligned with that of the main Western countries (where it ranges between +20% and +25%) and driven both by the more consolidated applications that exploit "traditional" cellular connectivity (€3.2 billion, +14%) and those that use other communication technologies (€3 billion, +36%).

The component of services enabled by connected objects is up 28% to EUR 2.3 billion. “Smart Metering" and "Smart Asset Management" in utilities are the first segment of the market, with a value of €1.7 billion (+19% compared to 2018), accounting for 27% of total revenue, driven mainly by regulatory obligations, which led in 2019 to the installation of 3.2 million smart gas meters (58% of the total) and 5.7 million smart electric meters (37% of all electric meters). The growth of the smart metering market will continue in the 2020s, driven by legislation on gas and electricity meters and heat meters, for which the remote control obligation starts in October 2020 and will be applied first to newly installed meters until all meters in use are covered by 2027. Water smart meters are also attracting increasing interest, with calls for tenders dedicated to remote reading of water meters, allowing access to consumption, optimising the management of water networks and reducing losses.

The other sectors, in order of value, are: 'Smart Car', which is worth EUR 1.2 billion (19% of the market, +14%) and has 16.7 million connected vehicles, and 'Smart Building', with a value of EUR 670 million (+12%), mainly linked to video surveillance and energy consumption management in buildings. management of energy consumption in buildings. The segments with the most significant growth are the "Smart Home" (530 million, +40%), driven in particular by the boom in voice assistants, the "Smart Factory" (350 million, +40%), which in the last three years has benefited from the incentives provided by the National Plan Industry 4.0, and the "Smart City" (520 million, +32%), which has seen an increase in the number of projects launched by Italian municipalities and the birth of new initiatives and collaborations between public and private.

In line with the market average, however, there has been growth in 'Smart Logistics' solutions (EUR 525 million, +26%), used to manage company fleets and satellite antitheft systems, in 'Smart Asset Management' applications in contexts other than utilities (EUR 330 million, +22%), focused on the monitoring of gambling machines, lifts and vending machines, and in 'Smart Agriculture' (EUR 120 million, +20%), mainly dedicated to the monitoring of vehicles and agricultural land.

"SmartRetail' and ' Smart Health' are still marginal, but have good prospects: in the retail sector, IoT technologies make it possible to collect data on user behaviour in shops, which can be used to provide personalised offers and give useful indications to designers engaged in the development of new collections, while in the health sector they can improve the traceability of drugs and medical equipment in hospitals, integrate devices for monitoring vital parameters remotely with services such as sending drugs to the patient's home and video calling a doctor. By integrating these solutions with Artificial Intelligence algorithms, it is possible to use the data collected on a patient's behaviour, understand his or her habits and pick up any abnormalities or warning signs in advance.

The Industrial Internet of Things

Giovanni Miragliotta, Scientific Director of the Observatory, delves into the topic of Industrial IoT, a reality that is expanding in Italy, but not homogeneously: "The Italian Industrial IoT is a growing reality, especially among large companies, even if the delay of SMEs, among which only a minority knows IIoT solutions, starts projects and adequately exploits the incentives provided by the National Plan Industry 4.0, shows that there is still a long way to go". The survey conducted by the Observatory on a sample of 100 large companies and 525 Italian SMEs shows, in fact, that 97% of large companies know about IoT solutions for Industry 4.0 (it was 95% in 2018) and 54% have activated at least one IIoT project in the three-year period 2017-2019, while only 39% of SMEs have heard about these solutions and just 13% have launched initiatives.

The most popular applications are those for factory management (Smart Factory, 51% of cases), mainly used for real-time production control and preventive and predictive maintenance, followed by applications for logistics (Smart Logistics, 28%), dedicated to the traceability of goods in the warehouse and along the supply chain, and for the Smart Lifecycle (21%), with projects aiming to improve the development phases of new models and product upgrades. Wireless is the technology priority for the future, with 64% of large companies planning projects based on these technologies, while projects based on wired networks are decreasing (-5% compared to 2018). Initiatives using Low Power Wide Area networks are growing (12%, +7%) for monitoring environmental parameters in factories or warehouses and for product traceability.